Modern payment solutions require new e-payment gateways. At the same time, the Saudi Central Bank is actively helping to develop this niche in the country. At a time when the state supports new technologies and the number of investors in them is changing, the economic fintech market and online business are developing rapidly.

To understand the specifics of fintech technologies that are taking the industry by storm, you need to know the best payment gateway in Saudi Arabia. Then building a bridge between the client and the business will become much easier.

Payment gateway in Saudi Arabia is actively expanding its horizons. Due to such active development, the concept of Payment Access Point is becoming widespread in the digital economy. This is a rather convenient practice that modern businesses use to build relationships with several areas of work at once.

A payment access point is an interface or service that allows businesses to accept online payments through various payment methods. This way of processing money e-commerce transactions helps to establish a connection with the customer, the bank, and the business in Saudi Arabia at the same time. It is a kind of field that combines three important components of business in one resource.

Thanks to government reforms and the rapid transition to a digital-first economy, businesses can accept payments from local and international customers. This allows them to attract more investment and develop the sector towards digitalisation much faster. At the same time, such technologies combine more traditional payment solutions such as Mada, Apple Pay, Visa, and Mastercard cards.

A payment gateway encrypts data, processes the transaction, and sends requests to banks. Its advantage for businesses is that it transmits the payment status in real time. This helps to avoid fraud, increases the level of security, and ensures a smooth checkout for the buyer.

Gateway services today use many tools to be competitive in the market and attract new customers. Cybersecurity and protection of private data are top priorities for them. Support for widespread Saudi payments and compliance with the country’s laws are also important components.

To ensure security standards, modern entrance services use a bunch of tools. First of all, this list includes tokenization, 3D Secure analytics, SSL encryption, and other tools. They try to minimize the risks of leaking personal information and any other data. Their reputation and customer trust depend primarily on this.

Many customers and businesses have been using the same payment system for years and don’t want to change it. Therefore, it is important that the financial transaction systems supports as many methods as possible:

This will ensure greater commitment from potential users.

Integration with CMS, ERP and e-commerce systems allows you to quickly deploy payment services and optimize sales processes. Such platforms are especially convenient for young businesses. This significantly saves resources and automates work.

The Arabian market is filled with many services built on the basis of fintech. Choosing the most popular one here can be quite difficult, but it is worth paying attention to the key nuances.

Tap Payments is one of the most popular services in the Arab region. It offers simple payment links and web payment processing options. This service is used by businesses of various types and sizes. It unifies payment systems in the META region.

Moyasar supports Mada, Apple pay, Visa and Mastercard. It provides a wide range of solutions for cash circulation. It also supports subscription services.

Global entryways are also available in Saudi Arabia, offering local and international payment support. They also offer analytics and advanced transaction monitoring tools. This is important when a business operates in a foreign territory or when there is a large number of transactions. This cash flow tracking gives the business complete control.

Choosing the right method for conducting business allows you to secure your monetary assets and the finances of your customers. Businesses are not only responsible for the safety of their funds, but also for the security of transfers from consumers.

To determine the receiving option for yourself, you need to evaluate your registration on the payment platform. First of all, it is worth analyzing the volume of transactions and the type of product. No less important selection criteria are the target audience and analysis of consumer pain points.

Particular attention should be paid to the checkout flow. The set of payment options offered to the buyer during the order process should meet the needs of the business audience.

To better characterize a particular system, compare the following criteria:

This will allow you to get a complete picture of a particular platform.

The process of logging into the platform and setting up the workflow is the most crucial step. However, modern payment structures allow you to do things quickly and accept payments immediately after setup.

The easy integration process begins with registering on the platform and passing company verification. This includes submitting corporate documents and domain confirmation from the organization’s management. After activating the account, you need to connect the API, configure webhooks, etc.

Payment links allow companies to quickly accept payments without complex integrations. They can be generated in CRM, placed on social networks, messengers, etc. This is convenient for small businesses, freelancers, and sellers.

Before the official launch, it is important to perform full testing and verify all platform features. You need to make sure that payment confirmations are received consistently and the client receives a complete and understandable transaction status. Only then does the system go live.

The future of payment systems integrated with fintech chains is quite promising. Most businesses are gradually switching to this type of translation processing.

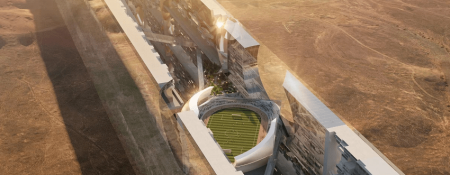

Saudi Arabia is actively promoting cashless payments, aiming to create a modern digital economy. Such solutions are integrated into the national strategy Vision 2030. And this, in turn, is aimed at growing online commerce, expanding financial services and strengthening innovation infrastructure.

In the future, AI is expected to rapidly develop in fraud detection to reduce risks. Also, advantages will be given to deepening analytics for sales optimization and behavioral insights.

Today, innovative payments are actively entering the market, namely biometric transactions, payments via smart devices, and intelligent solutions for merchants. This creates an ecosystem where payments become faster, safer and fully integrated into trade processes.