Forex prices are one of the most crucial indicators of a country’s economic health, which is why they are analyzed so heavily by investors and other professionals. But, have you ever wondered what factors dictate or influence these prices?

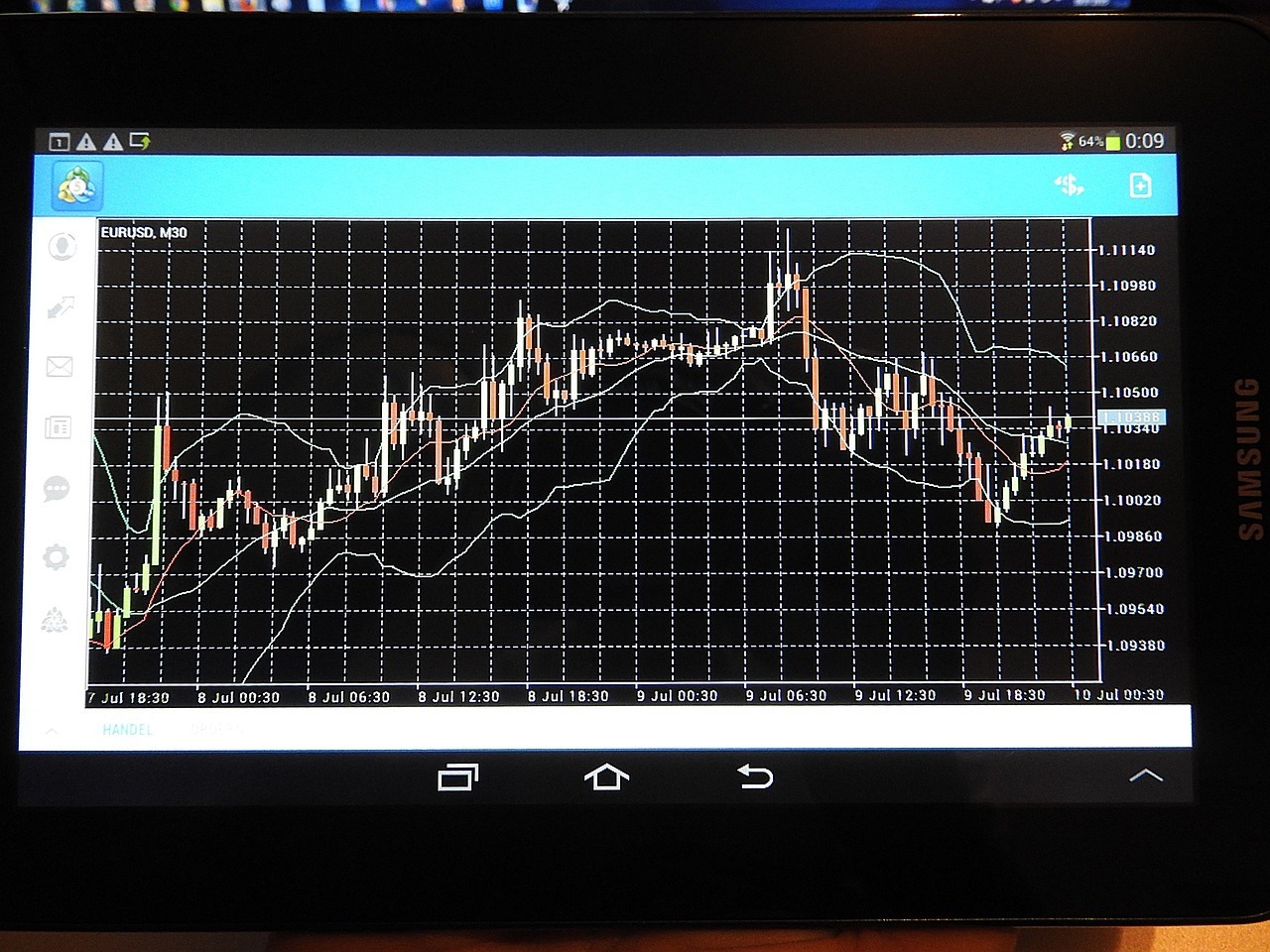

Before we look at these factors, what is forex trading? Forex trading is the buying and selling of currency pairs to profit from the differences in their princess. As with other markets, many investors buy low and sell high, but there are other ways of making money in this market like shorting.

Because investors and traders must understand forex markets to trade, let’s look at what affects them.

Inflation is an increase in costs in an economy. We understand it from a products and services perspective because that is what we experience in our daily lives. It can also be a general rise in the cost of imported products that makes the cost of the same products within a country’s borders increase. Inflation is expressed in percentages.

Inflation is crucial to forex prices because it dictates the buying power of a specific currency. For example, inflation rates decreasing in the UK could indicate that the purchasing power of the Pound would increase compared to other currencies.

Higher inflation rates tend to make a currency more desirable. The additional demand for that currency leads to its value and strength increasing. This makes it more attractive to include in traded currency pairs because it will perform well against other currencies.

Almost every country imports and exports products. The amount of exports and imports is a careful balance because it can tip the value of a currency. Countries that import more than they export experience an account deficit. This leads to a decrease in demand for the domestic currency, which then impacts forex prices.

Terms of trade can also impact forex prices. Every country sets the price of its exports and imports. Favorable terms of trade, where the price of exports increases much faster than that of imports, can strengthen a currency.

Politics plays a crucial role in the financial market and in the value of a currency. Foreign investors are more attracted to and tend to invest their money in countries with high political stability. This is because these countries present a much lower risk in their investments. A sizable injection of foreign investments and currencies can strengthen a domestic currency.

Conversely, unpredictability and political turmoil can damage the value of a currency because of investors leaving that country and much lower injections of investment funds.

When countries enter a recession, one of the first things they do to recover is reduce interest rates. When this happens, investors take their money out of these countries and invest in those with higher interest rates.

The forex market is always in flux and so is the price of forex. Investors must understand the different factors that impact forex prices, including interest rates, economic performance, politics and the resulting policies, trade and other factors, to make better decisions regarding their investments. This information is also crucial for helping investors understand how much to invest and the risk to take with a specific currency.

This section of articles cover a diverse spectrum of informative and engaging content that goes beyond borders of UAE and covers the rest of the World. From insightful explorations of scientific breakthroughs and technological innovations to captivating features on cultural phenomena and lifestyle trends, these articles provide our readers with a wealth of knowledge and inspiration. Whether uncovering the latest advancements in health and wellness, sharing tips for personal development, or spotlighting intriguing stories from around the world, this category serves as a trusted source of news and information.